Published by: Psytext

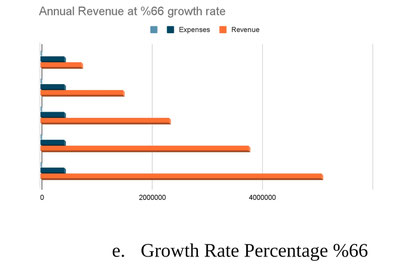

Financial information pertaining to your company's ability to generate revenue can be determined by an internal audit of your existing company, or by researching the reported statical data. How do you find your growth rate percentage? You can find your annual growth rate percentage by factoring in your company's current revenue, and weighing it against the outside changes that have been reported through any of the statistical recording data agencies. By measuring your own finances, and then comparing internal or external factors that may affect your type of company you will be able to isolate a percentage rate that is unique to your business. The next step is accurately comparing this percentage rate to the percentage rate of similar companies in your area. By taking into account your own unique management system, your location or some of the innovative measures you are taking, you will be able to determine what percentage rate is the best one to use to express your current financial value. Once you have an understanding of the factors that affect your company, you will be able to make innovative changes and be successful. If your revenue has been recorded and their is a coherent rate of growth, then monitor that information, and document it for future use.

Contents

1. Your Company's Potential To Earn

2. Industry Trends

3. Databases Charts and Graphs

4. Startup Costs

5. Pricing Structure

6. Budget/Expenses

7. Inventory

8. Shared Profit Margin

9. Financial Information and Accounting Details

10. Financial Projections

1. Your Company's Potential to Earn

Learning more about your company's potential, while understanding the business enviroment your working in. By measuring recorded data and information, you will be able to draw comparison to your

own companies ability to generate revenue. You can find this information by visiting websites like Statistics Canada, or you can integrate your own recorded financial details to create a forecast of what your next financial period may look like. After

you have come to a consensus of what the required information is, a mathematical algorithm can be generated that will demonstrate your potential financial growth. This can be expressed on a sale

by sale basis, or on an annual scale. When you understand your financial growth rate potential, you'll be able to pre-plan for any changes, or decide when you want to safely expand your

company.

2. Industry Trends

These are based on several different factors; the current industry trends in relation to your product or service based on the current market place. Your active and prospective clients purchasing and spending patterns need to be taken into account. You can access the recorded revenue information from companies related to your own by using online resources like Stats Canada (https://www.statcan.gc.ca/en/start). Finding out how much they earn will help determine your pricing structure, payroll and the overall limitations and abilities your company has. This data will be reflected against your own earning potential to create an algorithm. Recording this information is another reason why having a business plan is important. It demonstrates to others what you know you can accomplish, and leaves room for any changes, additions or alterations in the future.

3.Databases, Charts & Graphs

Creating a database helps you stay organized by itemizing items, prices and other information pertaining to your company's sale inventory. This database will include information that can be updated, and provide you with numerical data pertaining to each situation. You will need to have multiple databases in your business plan. This is in order to keep your information organized, and create a platform that can be used to make any changes that you need as your business grows and develops. There are different ways to understand, control and manage the financial aspect of your company, business or idea. One way is to create your own unique growth rate percentage algorithm. This can be done by taking the relevant sales data that your company has been able to generate, and comparing them to the current published market information. The numerical values that are inputted into your chart well make your percentage rates and financial information easier and more clear for your audience and investors to read.

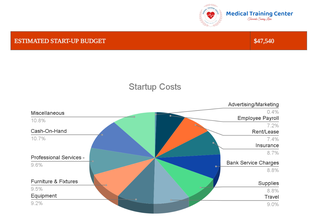

4. Start Up Costs

Your startup costs will be determined by what is required for the initial development of your company, organization, idea or project. They will include your monthly/annual budget, along with any differentials or external/internal factors that may be affected. Your start-up costs need to be an accurate list of what you will need to begin operating successfully. Your startup costs can also be changed based on different investment prospects as you obtain the necessary finances. Because you have created a database, you can alter, change and add information based on your needs and requirements.

5. Pricing Structure

The pricing structure of your business plan will depend on whether or not you're offering a product or service. It can also change if you are going to be offering any forms of discount or sales opportunities to your clients. The price instruction will help you decide what your budget is going to be.

6. Budget/Expenses

Your budget versus your expenses can be estimated by using recorded data, or can be explained by documenting your current financial status if your business is already in operation. Using a chart, or graph will help your readers understand how much you're earning.

7. Inventory

Recording your inventory will help you balance your revenue stream by managing how much each product needs to be sold for.

8. Shared Profit Margin

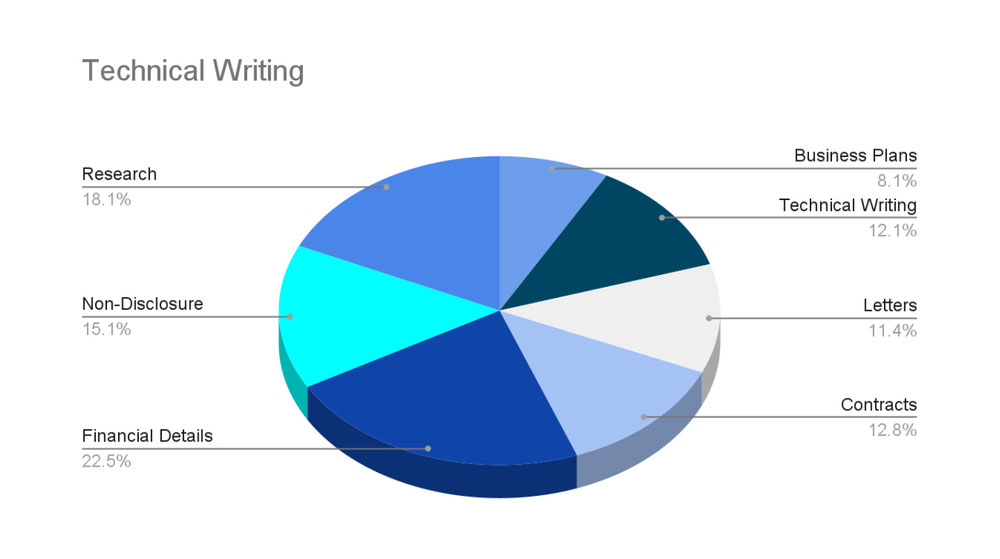

If your company has investors, or you are working with partners, then the shared percentage rate of the company's profit margin can be determined by using a predetermined percentage rate. Pie charts, or graphs can also be used to express these values. Companies that provide a product or products will need to find out what percentage each one of their products is going to cost them in the long-term, or how much the market will affect their ability to reach their audience. This can be broken down into another percentage rate after finding out what the exact changes to the market will be.

9. Financial Information, and Accounting Details

Accounting details can be created in a format structured for your own personal database. Because every business is unique, creating a system that is relevant to your company will help you stay organized. This includes your current, and projected financial details. Your financial details include your start-up costs, your projected gross income, your payroll, licensing cost and any other expenses. Your 4-year projection is based on the statistical recorded data of similar organizations in relation to your businesses financial ability. Your financial information will also be in direct relation to your company's ability to generate income.

10. Financial Projections

To growth rate percentage will be calculated by dividing your current Revenue by your expenses covered in multiplying that number by 100. If you can provide sales information from your previous financial reports, then generating future growth rate percentages will be easier. This is because you'll be able to use information that you already have.

Would you like to start working on your next business plan? If you are ready to begin, please click the get started button below.

Write a comment